kentucky home improvement tax deductions 2009

Kentucky Tax Credit for Renewable Energy and Energy Efficiency ...

Sep 29, 2008 . Starting in 2009, Kentucky residents can claim a credit of up to $500 on their . energy system or making energy efficiency improvements at home.

http://voices.yahoo.com/kentucky-tax-credit-renewable-energy-energy-1954163.html

State Income Tax Breaks in Kentucky - Yahoo! Voices - voices ...

Mar 11, 2010 . On your Kentucky state tax return you can deduct retirement income and health . a new home, for energy efficiency improvements, for education and for families . or less (for 2009) you may qualify for the family size tax credit.

http://voices.yahoo.com/state-income-tax-breaks-kentucky-5616492.html

-

Comprehensive Coverage

-

Economic Stimulus Package- Income Tax Deductions - Yahoo ...

Feb 21, 2009 . Economic stimulus package tax deductions, rebates, energy credits, carbuyers, . light truck or motor home during 2009, the sales tax is deductible up to a . Extended Energy Credits- the energy saving tax credit for home improvements has . Kentucky State Income Tax Tips-Some Basic Tax Deductions .

http://voices.yahoo.com/economic-stimulus-package-income-tax-deductions-2708796.html

Deductibles

-

A Guide to Federal Tax Credits for Energy Efficiency

to access tax credits when conducting certain home improvement projects. It . Ohio Montgomery, Ohio Ft. Thomas, Kentucky Lexington, Kentucky . The products selected met the performance specifications outlined in the tax credit. 2009 .

http://www.marshbuild.com/pdf/Consumer%20Tax%20Credit.pdf -

State Mandates

-

Home Energy-Efficiency Improvement - Planning and Design ...

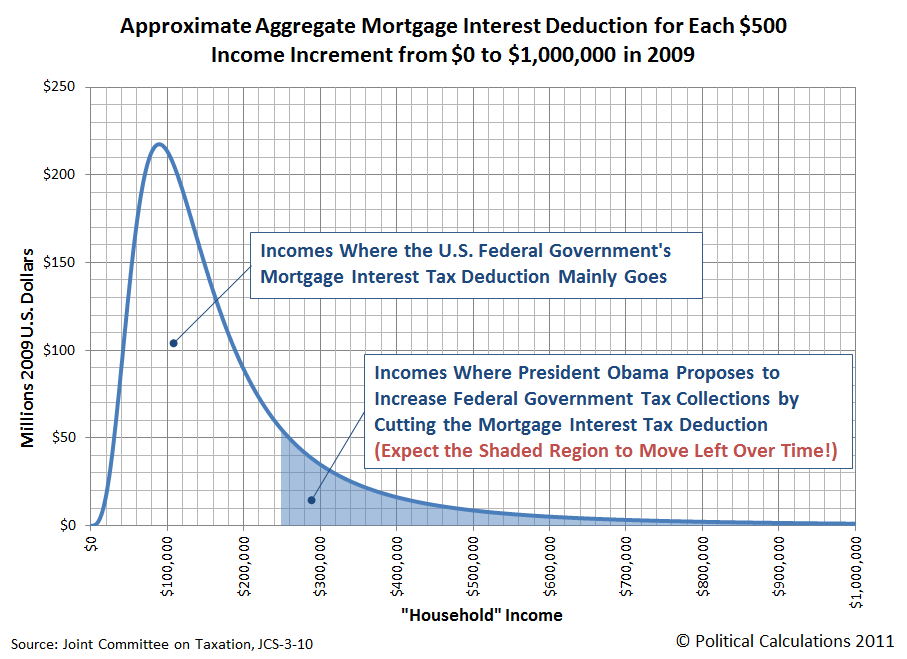

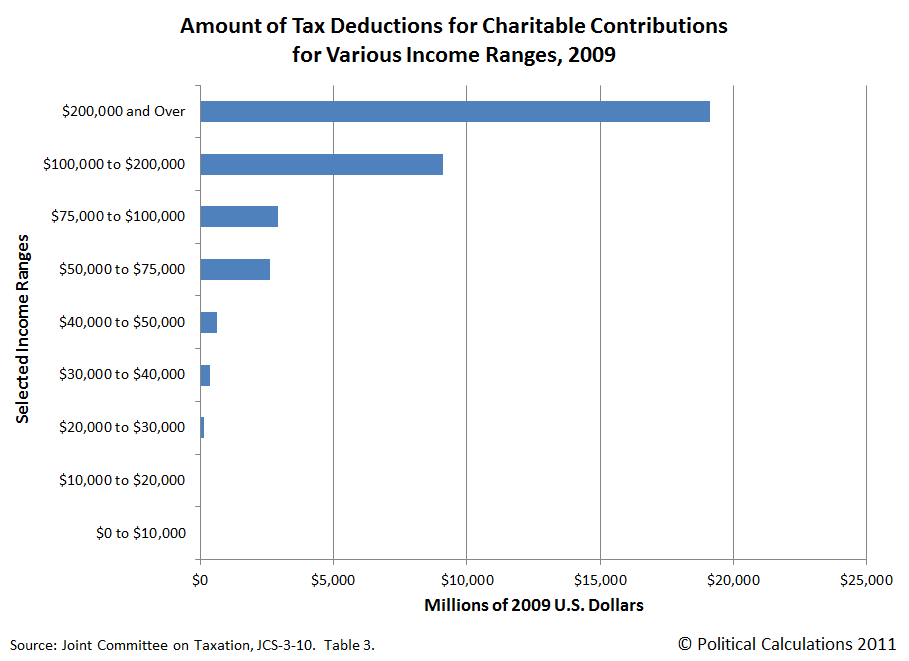

For improvements made in 2009 and 2010, you can get an income tax credit of up . Tax deductions – such as those for home mortgages and charitable giving .

http://www.louisvilleky.gov/PlanningDesign/Home+Energy-Efficiency+Improvement.htm

Surcharges

-

Tax Credit for Energy-Efficient Home Improvements - Energy ...

The tax credit can be claimed for home improvements made from Jan. 1, 2009, through Dec. 31, 2010. A tax credit is particularly valuable because, unlike a tax .

http://www.lendingtree.com/smartborrower/home-renovation/remodeling-ideas/energy-efficient-home-improvement-tax-credit/

-

References

Kentucky tax tidbit: $5K new home credit - Don't Mess With Taxes

Mar 7, 2010 . Kentucky's New Home Tax Credit is available to eligible individuals who purchase a new primary residence between July 26, 2009, and July 25, 2010. . recoup some of that cost by claiming the home improvement tax credit.

http://dontmesswithtaxes.typepad.com/dont_mess_with_taxes/2010/03/kentucky-tax-tidbit-new-home-credit.html